The Haven, one of the leading educational platforms for crypto traders, is Alpha Mail’s go to for all things education.

Featuring exclusive content from: @CryptoUB, @LomahCrypto, @pierre_crypt0, @LSDinmycoffee, and @ColdBloodShill, The Haven offers comprehensive resources such as livestreams, educational videos, journals, daily market updates and a large, helpful and welcoming community.

Join The Haven today.

@Byzgeneral is a cartoon tiger pressing buttons in crypto since 2017.

How did you get into crypto trading?

I was introduced to crypto when my cousin told me about Bitcoin in 2017. He’s a smart guy, so when he tells me something I tend to listen. I quickly found out it’s pretty much the only truly free and open market in the world. When I joined crypto was still in its very early stages so there were still opportunities to be found everywhere. In terms of trading, I have always liked the idea of being my own boss and generally having freedom.

How long have you been trading?

5 years in total although I’ve only been trading full time for a year. Before that, I was mostly investing while I had a regular job.

How did you manage to carve out time to learn crypto when you were working full-time?

When I discovered crypto I was a waiter - a job I hated. I then went to university to study finance because it interested me and I wanted a better career. During my free time, I constantly learned more about crypto/trading. The entire time I mostly invested in BTC/ETH and occasionally tried to sell and buy back at times that made sense.

When I graduated, I still didn’t really have the balls to go full-time crypto though so I ended up following in my dad’s footsteps and started working in real estate. I wasn’t really interested in this at all. I had a horrible time and didn’t learn anything except the fact that I don’t like working with people. Eventually, I said “fuck all this noise I’m doing what I want to do” and became a trader. Somehow worked out, although I’m not giga-rich yet. I’m but a humble tiger who’s very happy that I didn’t catapult myself straight to perpetual poverty.

“I HAD A HORRIBLE TIME AND DIDN’T LEARN ANYTHING EXCEPT THE FACT THAT I DON’T LIKE WORKING WITH PEOPLE. ”

— @BYZGENERAL

Speaking of the tiger, what’s the story there?

Back when I joined CT people joked that the community was basically an animal farm as so many people used pictures of animals. I wanted to fit in and I think tigers are cool so I chose that. I did commission the art though and asked to slap a helmet of a Byzantine general on the tiger as a reference to the name.

Is Byzantine a reference to ‘The Byzantine Generals’ problem’? Are you a BTC maxi at heart?

It’s indeed a reference to the Byzantine General’s paradox which I learned about by reading Andreas Antanopoulos’ “Mastering Bitcoin”.

I guess I’m a BTC maxi at heart. It’s the coin that started all of this, for a long time it was the only coin that was relevant and to this day it’s still more important to this space than many newcomers realise. It’s also literally the most robust and decentralised network and the fact that it’s “boring” and doesn’t do much is actually a good thing. We need something like that. I feel like BTC will continue to be boring and gain some sort of reserve asset status.

I’m not your typical maxi though because I trade altcoins and genuinely like some other projects. I’m very much a fan of ETH for example. I’ll go even further and drop a controversial one: I think the ETH flippening will happen.

Bitcoin will always have a special place in my heart though.

Moving onto trading, how long did it take you to become profitable?

3 - 4 years to become consistent, before that it was massive ups and downs because I didn’t really know what I was doing. Analyzing the market and trading profitably are two different things. Even once I was able to analyze what was going on it took me a while to figure out how to trade properly. Lots of trial and error, luckily I never got fully blown out.

“ANALYZING THE MARKET AND TRADING PROFITABLY ARE TWO DIFFERENT THINGS.”

— BYZGENERAL

What does your daily routine look like?

Spoiler: it’s not very exciting.

I don’t have a fixed schedule or hours that I work. Because I’m mainly a swing trader now I don’t really need to be active all day every day. But when I wake up I usually start by looking at the market, first crypto then legacy to get an idea of the global risk on/off situation. I read up on some financial news on Bloomberg. Then I manage my positions if necessary.

If I enter a new trade, I tend to set it up and immediately close the window, I start making mistakes if I keep staring at the chart. Then I read messages. Networking is very beneficial in this industry so I spend a lot of time just talking to people and I also always get loads of questions from followers, I do try to answer most. Then workout or jogging. Trading is all about psychology, exercise is important for both a healthy body and mind. Then I play video games for the rest of the day if I don’t have to do anything else.

What's the worst thing about trading?

If you fuck up you don’t just waste time or get scolded by your boss or whatever like in a traditional job, you actually lose your capital. The punishment for trading badly is very severe, your hard-earned money is on the line. It can be stressful and you’re on your own.

How do you mitigate this stress as a trader?

I think that trading isn’t for everyone. Some people naturally cope better with stress. But you do learn to deal with it better over time and from experience. I think the key is figuring out what works for you. The first time you enter a leveraged trade and see red PNL you freak out, the 1000th time you’re more battle-hardened.

“THE FIRST TIME YOU ENTER A LEVERAGED TRADE AND SEE RED PNL YOU FREAK OUT, THE 1000TH TIME YOU’RE MORE BATTLE-HARDENED. ”

— BYZGENERAL

Tell us about a time a position has stressed you out.

I took a fat L during the infamous March 2020 black swan crash. It made me doubt for a moment whether I was cut out for trading.

But I never put money on the line that could ruin my life. I think that’s a rule you have to set for yourself. Taking big risks is fine, but don’t bet money you really can’t afford to lose, definitely don’t go into debt.

If you do blow your bankroll, GG, accept the loss, and go back to waiting tables. Save up some money and try again in a year maybe. In the meantime, you can still do some airdrop hunting for example with small amounts of money and maybe you’ll get lucky. The barrier to entry and to be able to play in crypto is much lower than in any other market.

Would you share with us your most memorable trade?

Most memorable is probably one of my first altcoin trades ever. In 2017 I bought Lisk and the very next day it went up almost 100% and that’s probably also the exact moment when I got hooked. I thought to myself “what the hell is this market?”, but in a good way.

I went on to put my Lisk profits into Bitbean, but I immediately sold because I thought “Bitbean” was too ridiculous. It then proceeded to rally like crazy and my friends and I laughed a lot about how I missed the opportunity of a lifetime on fucking Bitbean.

“I MISSED THE OPPORTUNITY OF A LIFETIME ON FUCKING BITBEAN.”

— BYZGENERAL

What’s the best trading advice you’ve been given?

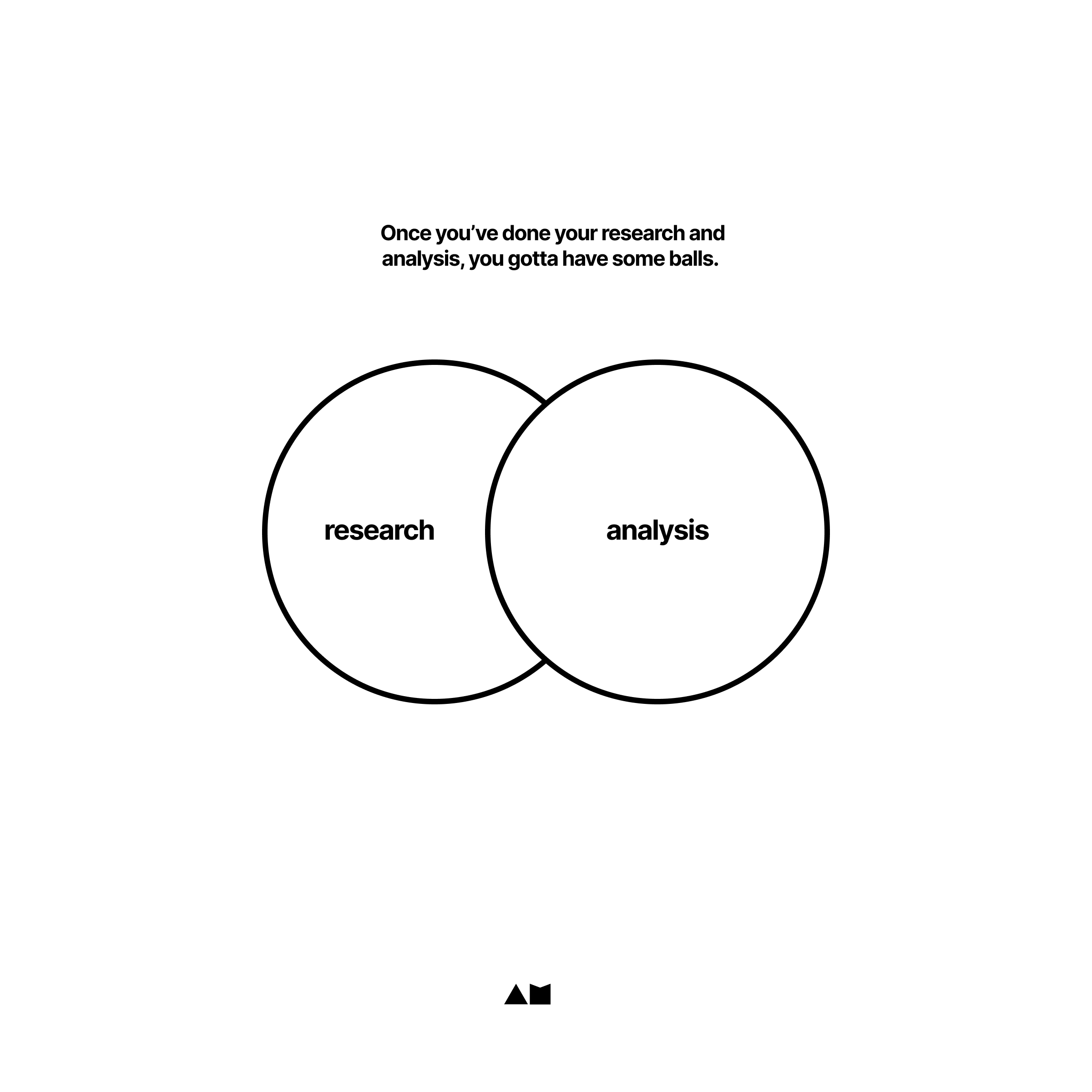

Conviction. It’s not really something anyone specifically told me, but I just learned this from other great traders by observing them. I used to make a lot of mistakes by simply being unsure. Once you’ve done your research and analysis you just gotta have some balls.

How about some conventional wisdom?

“I always buy too early and sell too soon” - Baron Rothschild.

This always reminds me not to try and time the absolute bottom and top. That shit is very risky. Most successful traders tend to get out a bit too early when they see general euphoria which could indicate a cycle top. They might miss out on 20% more upside or something but they also miss out on the 80% drawdown, and when the inevitable drawdown happens they have plenty of cash on hand.

“The market is a device for transferring money from the impatient to the patient.” - Warren Buffet.

No matter what you think about him, he’s said some smart things in the past. This is one of his better quotes and is very relevant to crypto, especially in a bull market. Pretty much the only way you can really fuck up in a bull market is by buying coin A, it doesn’t really move and you see coin B pumping so you dump coin A and buy coin B during its pump. Now coin A starts pumping but you sold at the local bottom and coin B is not doing anything anymore. This cycle continues. Happens to a lot of rookies. Sometimes you just need a little bit of patience.

What's the most important quality in a trader?

Conviction and patience. These didn’t come easily to me. I was naturally good at being patient, but even that becomes hard when you don’t have conviction. I became better at this by focusing more on myself. In the beginning, I paid too much attention to what other people had to say about the market. It influenced my opinions so much to the point where I didn’t really have my own opinion, just a mix of other people’s opinions.

“I PAID TOO MUCH ATTENTION TO WHAT OTHER PEOPLE HAD TO SAY ABOUT THE MARKET. IT INFLUENCED MY OPINIONS SO MUCH TO THE POINT WHERE I DIDN’T REALLY HAVE MY OWN”

— BYZGENERAL

I tried to cancel out all the noise and only trusted my own analysis. This also makes it easier to learn from mistakes because you actually understand why something went wrong because you came up with the trade idea and not someone else. At that point you’re good, practice makes perfect, and eventually, you’re bound to have more confidence in your own capabilities.

Why do you think you have success trading?

I think I understand the crypto market pretty well. Whenever I post anything on Twitter I see so many people ask the most ridiculous questions or make such strange comments about it that it’s clear to me that they have no idea what’s going on, but most (if not all) of those people are also trading…

Is understanding the underlying market the key to success then?

I think trading is a lot like poker. Traders don’t try to predict the future, we just play by the odds and take calculated risks. Know your odds of winning in any given situation and play for long term profitability. I think if you know how to play poker really well it’ll make it a lot easier for you to understand what trading really entails.

What's something you've learned in the last six months that has made you a better trader?

I’ve noticed that the way a lot of traders I look up to trade is by making logical connections simply by taking a step back and thinking about everything that’s happening in this space. To give a quick recent example: Facebook changed its name to Meta, clearly implying that metaverse was very high on the agenda. Microsoft recently also started showing some interest in it. Meanwhile some of these crypto metaverse projects (SAND for example) raised money from top VCs. Many traders I know got into these trends early and reaped the rewards. There’s no technical analysis here, no indicators, nothing you would typically use, except for some common sense and taking a step back and just thinking about what’s happening. I think people who can connect the dots like that will always have an edge.

What's the mistake you find hardest to avoid when trading?

FOMO is a very strong emotion that’s very hard to fight, even if you already have quite a bit of experience. If you’re entering a position because of FOMO chances are always very high it’s not gonna work out.

Also fiddling too much with your position. This goes back to the conviction and patience thing. Once you made a decision, you gotta be patient and stick to your guns.

Do you put any checks or rules in place to stop you from aping into stuff or tinkering too much with a trade?

It still happens sometimes. Set and forget really is the best way to deal with this, at least for me. If I enter a position and I then keep looking at the 1-minute chart to see how it’s going I sometimes get emotional and start to make changes to the trade. This usually doesn’t end well. The best trades I make are the ones where I come up with a plan, set it up and then forget I even took the trade until either targets or stops start to get hit.

If you could give someone starting trading tomorrow one piece of advice what would it be?

Look at what other people are doing, more specifically look at what strategies they’re using and how they’re trading. Look for something that makes sense to you and then become an expert at that. There’s no one holy grail strategy, there are lots of ways to make money. I know traders that only use technical analysis, I know orderflow traders, I know people that only check etherscan and follow profitable whales, … Just familiarise yourself with what’s out there and find your groove.

There’s no secret, no shortcut, no magic way of becoming filthy rich quickly with no effort even though everyone wants to think there is such a secret. There’s only hard and smart work. You gotta put in the effort and actually do it yourself. I see a lot of people just copy what others do. Learning from others is fine, but you gotta do the research and work yourself otherwise you’re just a sheep. There are only sheep and wolves in this market. If you keep being a sheep you might be able to tag onto the success of a wolf for a while, but eventually, you’re gonna get eaten.